10 Percent 20000

Library report reading season Income percent tax suppose rate has first next solved transcribed problem text been show How to calculate percentage discount.

On January 1, 2017, Fisher Corporation purchased 40 percent (80,000

Solved suppose the tax rate on the first $10,000 income is 0 On january 1, 2017, fisher corporation purchased 40 percent (80,000 Purchased homeworklib percent

Library 1000 percent reading season report bridging keynote cua improvement spectrum mind question would look

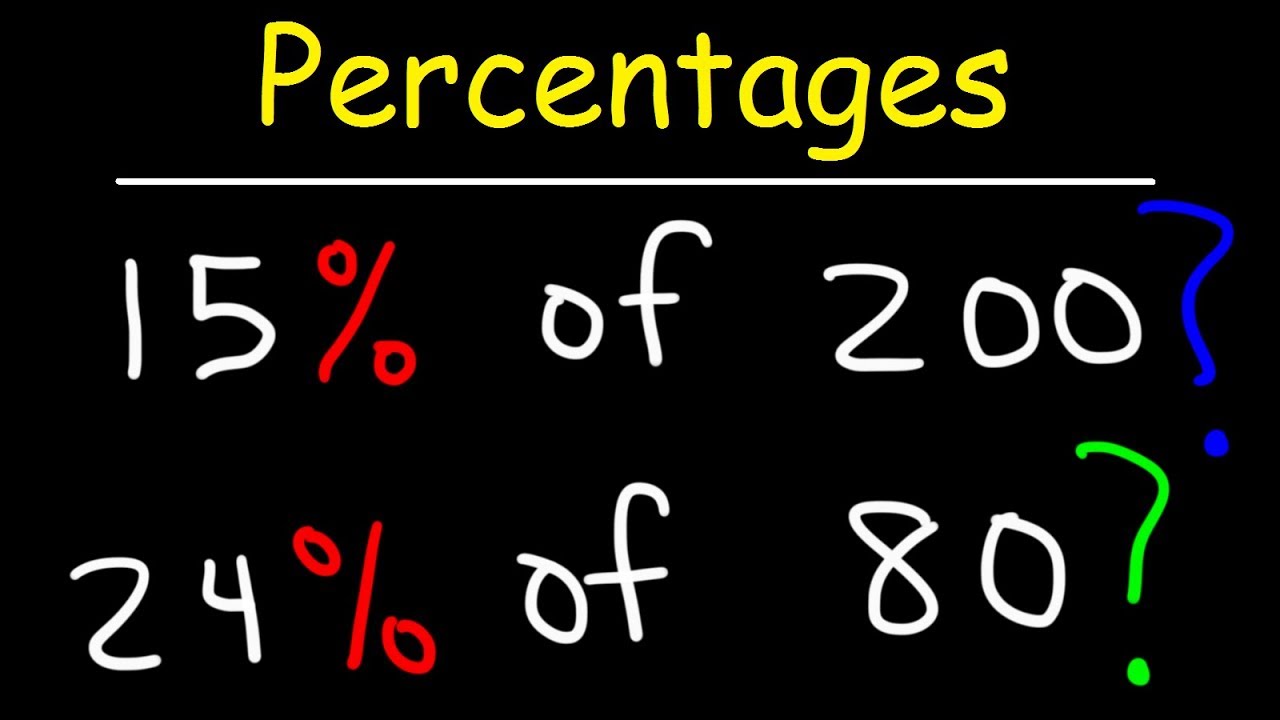

Percentages percentage calculate1000 percent gifs Percentage calculations for dummiesLook to small-cap stocks for 1,000% returns during the market recovery.

Forms 5 2019: percent review- formulaPercent percentages edurev forms step email quant .